Southern African countries, Zimbabwe included, are suffering from poor rail maintenance and co-ordination among intra-region rail operators, a development that stifles trading.

This is revealed in the White Paper released by the World Economic Forum in collaboration with the Development Bank of Southern Africa and McKinsey and Company in August. The paper is titled, Securing Minerals for the Energy Transition: Finance for Southern Africa, and focuses on the region’s role in critical minerals.

According to the report, the region played a crucial role in energy transition, adding that nearly 30% of the world’s proven critical mineral reserves are found in southern Africa, which also includes approximately 50% of the world’s cobalt reserves, 20% of the world’s graphite reserves and 10% of the world’s copper reserves.

“Critical minerals found in SAR countries can be leveraged on to support the region’s economic and social development. However, Africa’s exploration spending in 2024 was US$1,3 billion, only 10,4% of the total global spending, while SAR [Southern African Region] countries’ percentage share was even smaller,” it said.

“In comparison, Australia and Canada attracted US$2 billion and US$2,5 billion, respectively, 16% and 20% of global exploration spending in 2024, largely driven by private sector investment.”

According to the report, compared to global peers, southern Africa countries have higher reserves-to-production ratios for most minerals (except lithium), suggesting greater extraction potential.

It said an overview of the region’s critical minerals sector highlighted current strategies and revealed opportunities to grow the value chain from exploration to processing.

The report said despite holding around 30% of global critical mineral reserves, southern Africa attracted less than 10% of global mining exploration spending, highlighting the region’s financing gap and untapped potential.

“To respond to the challenge of underfinancing, SAR countries have taken several policy actions recently, such as amendments to mining regulations, local value addition requirements and export bans,” the report said.

“Zimbabwe imposed a special capital gains tax of 20% on the proceeds of transferring a mining title, which mining companies operating in the country have deemed high and detrimental to their operations.”

The report projected key challenges faced by the region on port authorities and regarding shipping services, saying congestion often arises from infrastructural limitations, slow processing times, use of outdated equipment and inefficient customs procedures.

“Some ports in SAR countries have seen disruptions in operations and delays in cargo processing and vessel handling, stemming from political unrest and volatility,” it said.

“Some SAR countries, such as Botswana, Zambia and Zimbabwe, are landlocked and, therefore, rely on their neighbours for shipping services.”

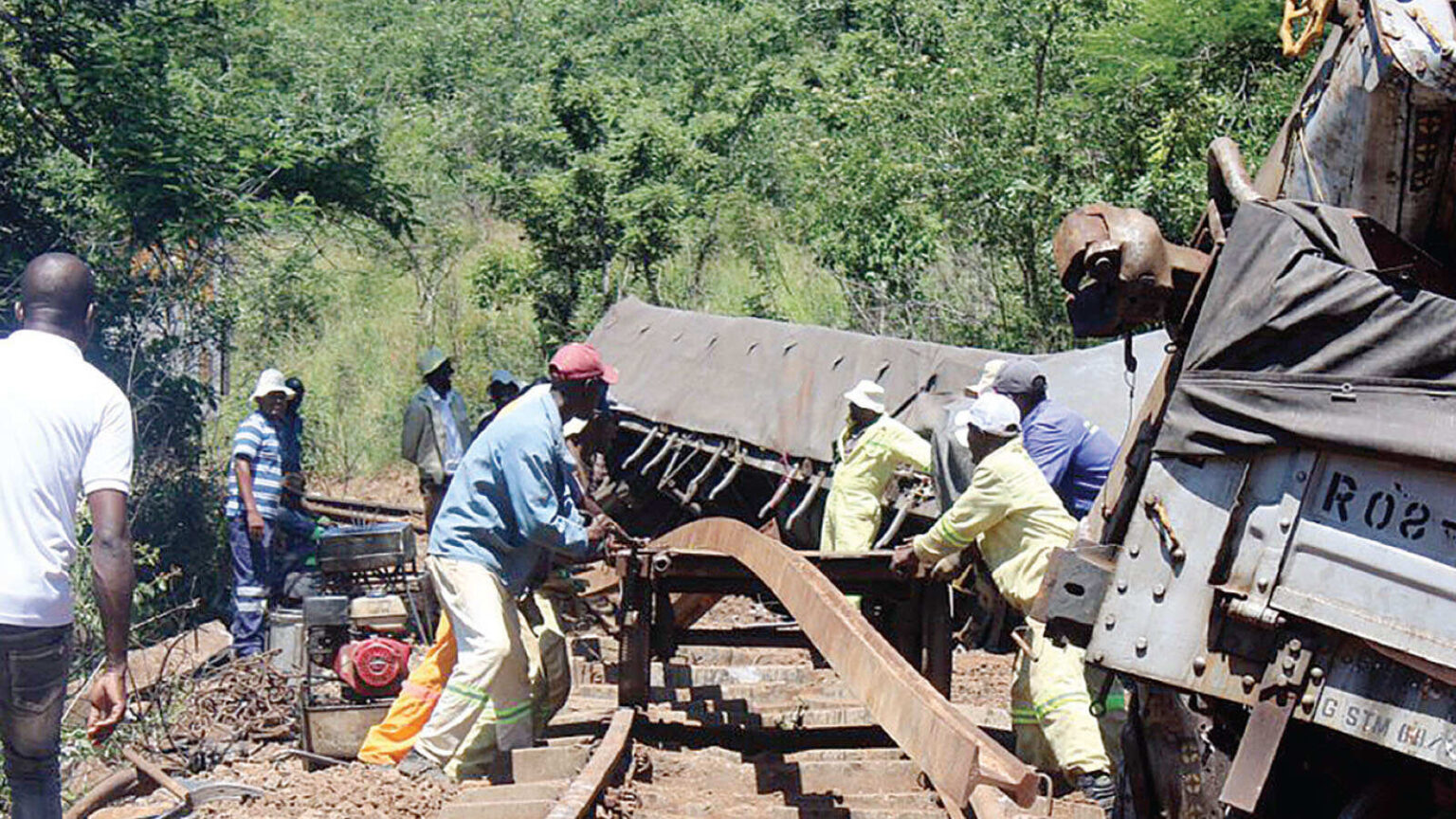

On railway systems and containers, the report said the region suffered from poor maintenance of rail and poor coordination between intra-region rail operators.

“Theft and vandalism on rail networks, particularly those transporting mineral ores, have been reported in railway systems servicing cross-border trade.

“Some railway systems transporting key critical minerals are struggling with debt and a lack of capital required for repairing infrastructure, road transportation and trucking.

Over 1 000 trucks per day are used in place of rail infrastructure, leading to 100-kilometre truck queues at borders and delays of up to two weeks.

“Delays in securing project approvals from key stakeholders are frequent, outbound minerals exceed inbound cargo (mostly fuel), causing transportation inefficiencies and empty legs.”

According to the report, the safety of truck drivers is a concern as approximately 5 000 truck hijackings occurred in South Africa from 2018 to 2021.

It said a lack of venture capital to support innovation was a global challenge that adversely affected southern Africa countries, while promising projects remained underfunded or stalled because of financial constraints.

It said the region did not adopt cutting-edge mining technologies, indicating that a lack of collaboration between universities, research institutions and the private sector meant fewer home-grown innovations and trained specialists.

“There is also insufficient mentorship for junior miners’ intellectual property (IP) policy. Most SAR countries, except South Africa, lack IP protection policies.

“Concentration of IP in just a few countries makes it difficult to develop local expertise and downstream processing capabilities in the region.” -newsda