Contango Holdings PLC, the London-listed developer of the Muchesu Coal Project in Binga, has received a proposal from Pacific Goal Investments Private Limited and Huo Investments to subscribe for approximately £5 million by issuing a total of 450 450 451 new ordinary shares.

PGI is a Zimbabwe-focused investment vehicle equally owned by Mr Wencai Huo, the principal of Huo Investments, and Mr Liu Jun. The two investors are long-term strategic partners with a keen interest in unlocking value from Zimbabwe’s vast mineral endowment.

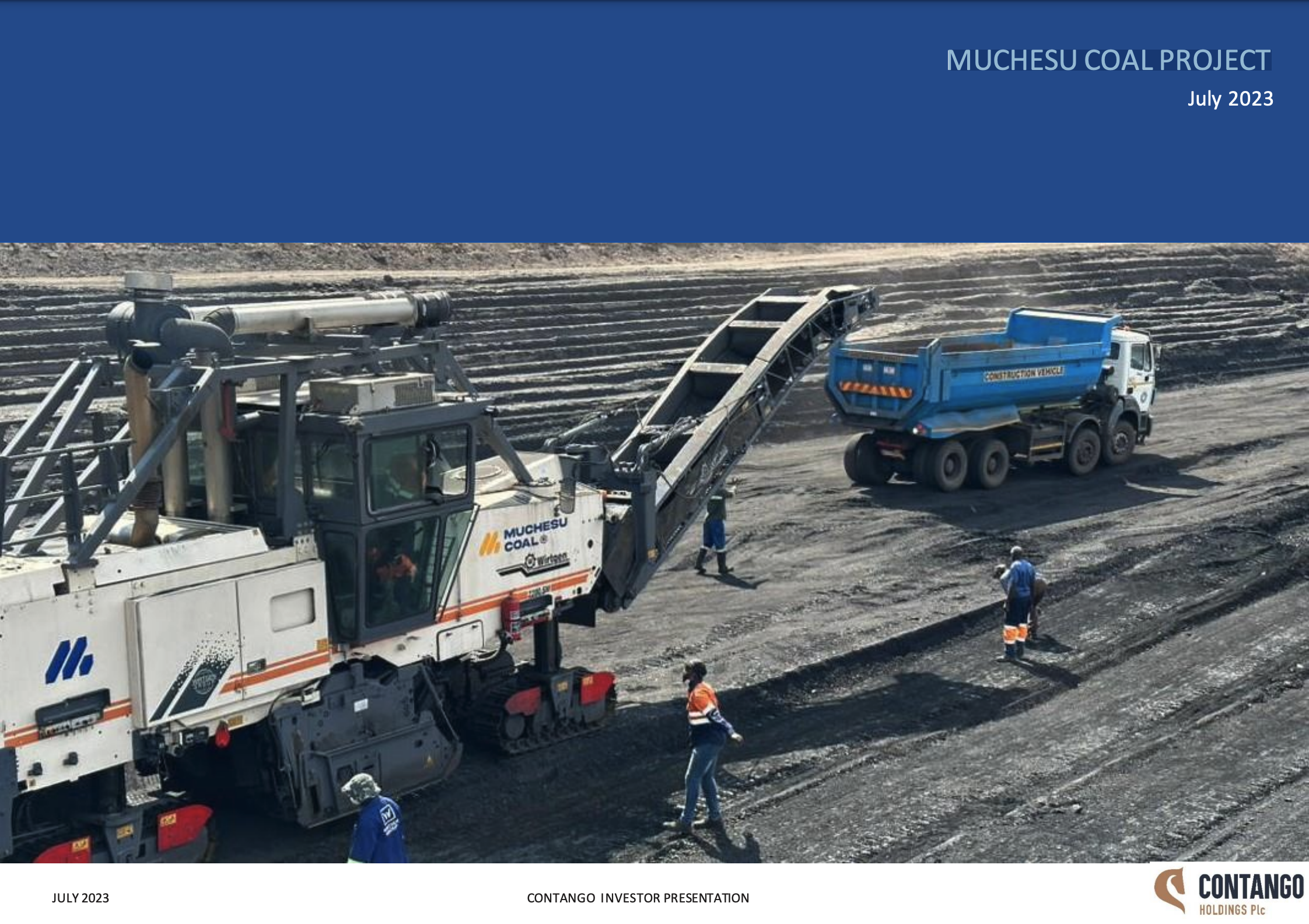

The Muchesu Coal Project is crucial to Zimbabwe because it expands the country’s energy and industrial capacity, boasting over 1,3 billion to 2 billion tonnes of coal resources. Commissioned in August 2023, it has the potential to drive economic growth through exports of high-grade coking coal, supports local power generation and brings foreign direct investment.

Mining generates over 70 percent of Zimbabwe’s export earnings and contributes between 12 and 15 percent to the gross domestic product, while it employs thousands across the country.

The share subscription proposal to the company is expected to recapitalise the company and allow it to repay all existing shareholder loans.

The transaction is expected to leave the company debt-free and in a position to pay dividends to shareholders as royalty income grows at its flagship Muchesu project.

The Muchesu coal project is a potentially transformative industrial anchor for Matabeleland North Province, with expected ripple effects on employment, infrastructure development and downstream industries such as power generation and mineral processing.

Under the terms of the proposal, PGI and Huo Investments intend to subscribe for 358 680 794 and 91 769 657 new ordinary shares, respectively. This will give the Strategic Investors proposed ownership of 29,7 percent and 20,4 percent, respectively, in the enlarged share capital.

Huo Investments currently holds 154 750 000 ordinary shares in the company, while PGI presently does not have any shareholding in Contango.

The subscription price represents a 39 percent premium to the mid-market closing price on February 12, 2026 — a strong vote of confidence in the company’s underlying value and prospects.

Discover more

Album debut announcement

News subscription service

Health lifestyle tips

The proposed subscription remains conditional upon the passing of certain resolutions at a general meeting and the obtaining of a Waiver of Rule 9 of the Takeover Code. The company and its advisers are consulting with the Takeover Panel and will publish a circular for the waiver of Rule 9 of the Takeover Code and arrange a general meeting in due course.

Contango chief executive officer Mr Danny dos Santos said the transaction marked a significant turning point for the company.

“I am delighted to announce this conditional Subscription at a healthy premium to current trading levels, which will recapitalise the company and enable us to repay all existing shareholder loans.

“ This will leave the company debt-free and now in a position to pay dividends to shareholders as royalty income grows at Muchesu,” he said.

The capital injection is expected to strengthen Contango’s balance sheet and provide a firm platform for expansion, particularly as operations at Muchesu continue to mature.

Mr dos Santos noted that Huo Investments’ participation demonstrates continued confidence in the company’s strategic direction.

Discover more

Political analysis

Radio station merchandise

Sports event tickets

“Huo Investments are already a major shareholder and I am pleased they have elected to maintain their percentage ownership in the Company through a pro rata investment of approximately £1 million.

“PGI have undertaken material capital investment at the site already and with their circa £4 million participation in the subscription, they will become our largest shareholder,” he said.

Combined, the long-term strategic investors will hold approximately 50 percent of the enlarged share capital, underscoring what management describes as strong alignment between new capital providers and existing shareholders.

“Combined, the long-term Strategic Investors will have an approximate 50 percent stake in the company and are heavily aligned with existing shareholders to deliver value within Contango for the benefit of all shareholders.

“I look forward to providing further updates as we position Contango for a period of growth and expansion,” added Mr dos Santos.

The recapitalisation is expected to enhance Contango’s financial flexibility, allowing it to focus on maximising production efficiencies and scaling up royalty-generating activities at Muchesu.

In January, PGI was officially registered as the operator of the Muchesu coal project following approval by the Reserve Bank of Zimbabwe (RBZ).

The development marked a major milestone in the restructuring of one of Zimbabwe’s most strategically positioned coal assets in Matabeleland North Province, a region increasingly emerging as a critical hub in the country’s mining-to-energy value chain.

Large-scale coal production in Matabeleland North is expected to support Zimbabwe’s drive toward energy security, reduce reliance on imported power and provide feedstock for thermal power generation, coal-to-energy projects and industrial processing.

The project also has the potential to stimulate local supply chains, contractor development and skills transfer, while boosting provincial revenue streams and strengthening Zimbabwe’s export earnings capacity.

The province is the hub of coal-to-energy value chain investments, which will unlock up to US$1 billion under the coal and hydro-carbon focus.-herald