Diamonds & Dogs ::: Of desires for Exchange Rate to collapse & an electric zapper from Honourable Soda

Diamond: Zimbabwe Dollar

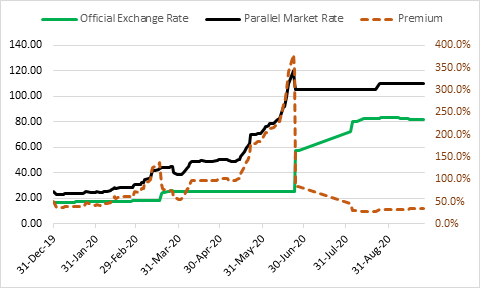

That the Zimbabwe dollar appreciated against the USD initially appeared phony more so as allotments on the Auction System had not materially changed. However, as successive auction allotments hit all time highs, the disbelief has migrated to cautious optimism. The central bank has also managed to put a muzzle on the Alternative Forex Market with the rate range bound as most players bring their needs to the reasonable priced Auction Market.

More and more are beginning to say that if RBZ can sustain the foreign currency supply at the Auction Market, that will be a game changer for the foreign currency market.

The stability obtaining is the sanity in the financial markets that most have been yearning for. It’s never really about the absolute level of the exchange rate but the ability to keep it stable while building confidence in the local currency for it to be eventually preferred as a mode of transacting.

For now the market can only speculate on the source of foreign currency. Definitely part of it comes from the mandatory 30% surrender requirements for exporters, 20% from liquidation of domestically generated foreign currency excluding balances in transitory accounts for direct insurance and pensions. Some exporters are also occasionally coming to sell their foreign though not big volumes as well as some NGOs. With the economy largely dollarized, some requirements for some players are being met through the USD purchases being made predominantly in sectors whose USD prices are competitive. What would not be sustainable is to use credit lines continuously; kick-starting the auction yes but sustaining it is a definite NO.

Diaspora remittances never find their way to the Auction market as recipients need the cash to transact.

The Alternative Market for currency has also largely remained range bound. The rate is largely within the 105-110 band and if more players can access currency on the formal market, the parallel market exchange rate is most likely going to come down.

Bulls n Bears is not oblivious to the aspect that perfect convergence of rates is an unlikely outcome as the markets are always imperfect especially in frontier and emerging economies. Certain needs can only be satisfied on the alternative market in the short term but so far the progress of the Auction Market is encouraging.

75% of CZI applicants getting FX allocations…

The Confederation of Zimbabwe Industries (CZI), reported that over 75% of the applicants from their membership for forex at the Auction Market are getting their Forex each week. Those declined are due to balances in Nostro Accounts, multiple bids, outstanding CD1 acquittals with exchange control. The process is also reportedly being done transparently (whatever transparently means). Furthermore, feedback from CZI members applying for foreign currency is largely positive and that inefficiencies are being raised and addressed throughout the trading weeks.

IF hands can be kept off the Fidelity & electronic printing presses, then we just might be in for a good time.

However, on the Twitter Streets, one can’t help notice the desire for things to go horribly wrong. Many appear to want stability but at the same time don’t look like they like the Team delivering the desired results.

As for Bulls n Bears, he is indifferent so long sustainable results can be delivered. What he wants is stability, never mind the faces behind it.

Dog: Electricity Supply

It made for sad reading that Dallagio Mining was considering having diesel generators as back up power for its Eureka Gold Mine in Guruve.

Listed crocodile skins exporter, Padenga acquired a 50.1% equity stake in Dallagio, a mining business which has interests in the Pickstone Peerless and Eureka gold mines in 2019 as it sought to diversify its revenue base.

Bulls n Bears remembers having the same conversation with Pickstone Peerless Executives just under a year ago regarding the use of diesel generators at the Chegutu Gold Mine. Back then notwithstanding the cost associated with a diesel generator run mine, the company was indifferent as diesel was heavily subsidised so it was possible to sustain a diesel powered gold processing plant. Come 2020, the mathematics is different as diesel is now very much market linked in the pricing and subsidies gone.

Any interruptions to power supply present an existential risk to mining houses. RioZim also cited unreliable power supply as one of the drag to its financial performance.

Zimbabwe had seen Kariba water levels reach favourable following fair rains in the catchment areas of the Zambezi River. However, this is proving to be not enough as demand for power increase. Furthermore, frequent breakdowns at Hwange Thermal Station have also posed risk to power supplies. Difficulties in SA may also affect optimal importation of power.

Missing Out on the Gold Price Rally…

The gold price has been attractive in recent months owing to investors seeking safe haven for their funds with a Year To Date USD return of 354%. And now imagine, mining houses missing out on the rally due to never ending power challenges.

Solar Run Mines

Recently, Canadian mining operator Caledonia Mining Corporation Plc. obtained $13 million through the sale of shares for the construction of a 20 MWp solar power plant for its Blanket gold mine in Zimbabwe.

The plant is intended to offset load shedding due to deficiencies in Zimbabwe’s national electricity distribution network.

The mine operator plans to implement the construction project for the solar power plant at its Blanket mine in three phases. The first phase will produce 6.55 MWp. In the first phase, during daylight hours, the facility will supply electricity to the Blanket gold mine located 15 km northwest of the town of Gwanda, in the province of Matabeleland South. At nightfall; work at the mine will be carried out using electricity from the grid and previously installed diesel generators.

The Canadian company has already planned a 40-hectare site for the installation of its future solar photovoltaic power plant.

Padenga Holdings also planned to commission a 1.2MW solar plant at its Crocodile farms. The Project completion was delayed by Covid-19 travel restrictions.

400kW was commissioned in 2019 at Kariba plus another 400kW at Ume Farm, while another 400 kW is ready and awaiting ZETDC to commission. The final 400kW is waiting for equipment that was held up in Spain due to lockdowns.

Once the commissioning is completed at Crocodile farms, the Group might be forced to consider the same approach at Dallagio if the power situation remains precarious and then supplement with diesel.

Going forward, it is crucial that Zimbabwe completes Hwange 7 & 8 whose progress was adversely affected by the COVID-19 induced lockdown.

The completion of various solar projects by various IPPs is also a key part to improving supply of power into the national grid.

But for now, Minister Soda Zhemu is unlikely to be anyone’s best friend.