ART Holdings intends to complete the disposal of non-core assets to enhance liquidity, restore profitability and enforce strict cost control across operations during the 2026 financial year.

The group will also relaunch its Softex tissue operations in Harare this month after successfully relocating and installing equipment from the Kadoma Mill closure.

Additionally, ongoing product innovation, particularly the successful launch of the EV10 pen, is anticipated to boost momentum in key segments.

“Key priorities for the year ahead include completing non-core asset disposals to unlock liquidity, restoring profitability, maintaining strict cost discipline, and leveraging the Group’s strong brands to regain market share.

“We are confident that Government reforms will continue to support a conducive operating environment, including stronger enforcement against illegal imports and counterfeits, encouragement of import substitution and local procurement, and broader macroeconomic stability,” the company said in its update for the year ended 30 September 2025.

The group recorded turnover of US$28,3 million, 17 percent below the prior year.

Overall volumes declined by five percent, reflecting the impact of reduced prices implemented to protect market share prior to Statutory Instrument 34 of 2025, ongoing liquidity constraints and intensified competition from imports.

Gross profit margins declined by 10 percent and the Group recorded an operating loss of US$0,8 million.

It noted that a loss after tax from continuing operations of US$1,4 million, coupled with a US$2,2 million loss from discontinued operations, resulted in a total comprehensive loss of US$3,5 million.

ART countered the difficult trading environment with disciplined cost management, achieving a 26 percent reduction in operating expenses, a key factor in limiting deeper losses and laying a foundation for recovery.

“Cost containment initiatives across the Group delivered a 26 percent reduction in operating expenses. Liquidity preservation and operational realignment remained key priorities, with capital expenditure limited to essential upgrades.”

Receivables and high inventory levels remain major focus areas as the group works to balance product availability with cash generation.

Performance across divisions was mixed but showed encouraging signs.

In the energy storage division, local battery volumes dipped marginally by 1 percent despite supply chain disruptions, while Chloride Zambia volumes fell 25 percent due to intense competition and payment challenges.

Export sales to Malawi and Mozambique, however, grew by 11 percent, underscoring the benefits of regional diversification.

The division also streamlined its distribution model, shifting towards company-owned shops to enhance control and efficiency.

The Stationery & Tissue segment recorded a steeper 9 percent volume decline, reflecting weak consumer liquidity, product returns in the first half and sustained pressure from imports. Nonetheless, the launch of the EV10 pen helped protect market share during the crucial back-to-school period.

Most notably, the Softex tissue unit completed its relocation and equipment installation, paving the way for a more agile and cost-effective operation as production resumes this month.

“Volumes declined by nine percent compared to the prior year as weaker consumer liquidity in the first half necessitated product returns from cash-constrained customers, disrupting normal demand cycles.

“The introduction of the new EV10 pen helped safeguard market share amid increased competition from low-cost imports. Gross margins decreased to 21 percent from 39 percent in the prior year due to pricing distortions during the peak back-to-school period.

“The division recorded an operating loss of US$0,6 million. Softex was predominantly in transition as tissue converting operations were relocated following the Kadoma Mill closure.

“Equipment installation was successfully completed, and production will commence in January 2026. The streamlined unit will be more agile and is now better positioned for recovery.

“The loss for the year of US$0,25 million includes retrenchment and relocation costs.”

The Timber division at Mutare Estates emerged as a standout performer, with volumes rising 15 percent on strong demand for structural timber, improved milling efficiencies, strategic pricing and tight cost control.

“Timber sales volumes exceeded the prior year by 15 percent, driven by strong demand for structural timber and improved milling efficiencies. Gross margins improved due to strategic price increases and efficient cost controls.

“The partial disposal of Mutare properties resulted in a 23 percent decline in rental income and a loss on disposal of US$0,4 million.

“Illegal mining activity on Inodzi Estate was successfully halted after a protracted legal process, and the Group has secured mining rights to enable active participation in the exploitation of the Estate’s resources.”

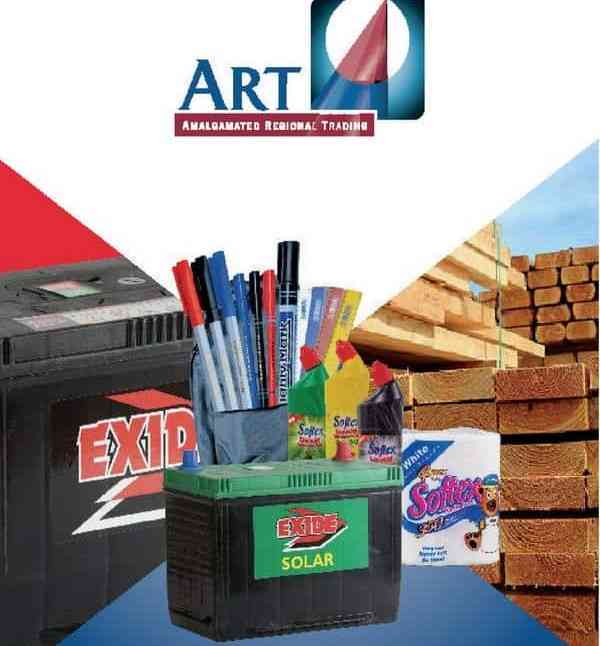

ART manufactures and distributes products in three key categories: paper products, stationery, and batteries.

Its product portfolio is divers ranging from tissue paper, sanitary ware and disposable napkins to writing pens and automotive, solar and standby batteries.

The company also has substantial interests in timber plantations and offers forestry resources management services.-herald