INEFFICIENCIES in Zimbabwe’s national rail infrastructure are driving up transportation costs for key bulk mineral commodities, severely undermining the country’s competitiveness in global markets.

Minerals Marketing Corporation of Zimbabwe (MMCZ) marketing manager, Mr Gumisai Nenzou, told journalists after the corporation’s annual general meeting last week that reliance on costly road transport was making low-value, high-volume minerals such as coal and chrome economically unviable for critical overseas markets.

“We see this as a challenge, especially when we look at low-value commodities such as coal and chrome. We have a lot of overseas markets that are looking for these products, but because of the challenges with our infrastructure to move the required volumes, that places us at a competitive disadvantage when we look at logistics costs” Mr Nenzou said. Transporting bulk commodities by road, particularly for long-haul exports to ports such as Beira, increases the final landed cost, eroding profit margins and undermining Zimbabwe’s price competitiveness against regional and international miners.

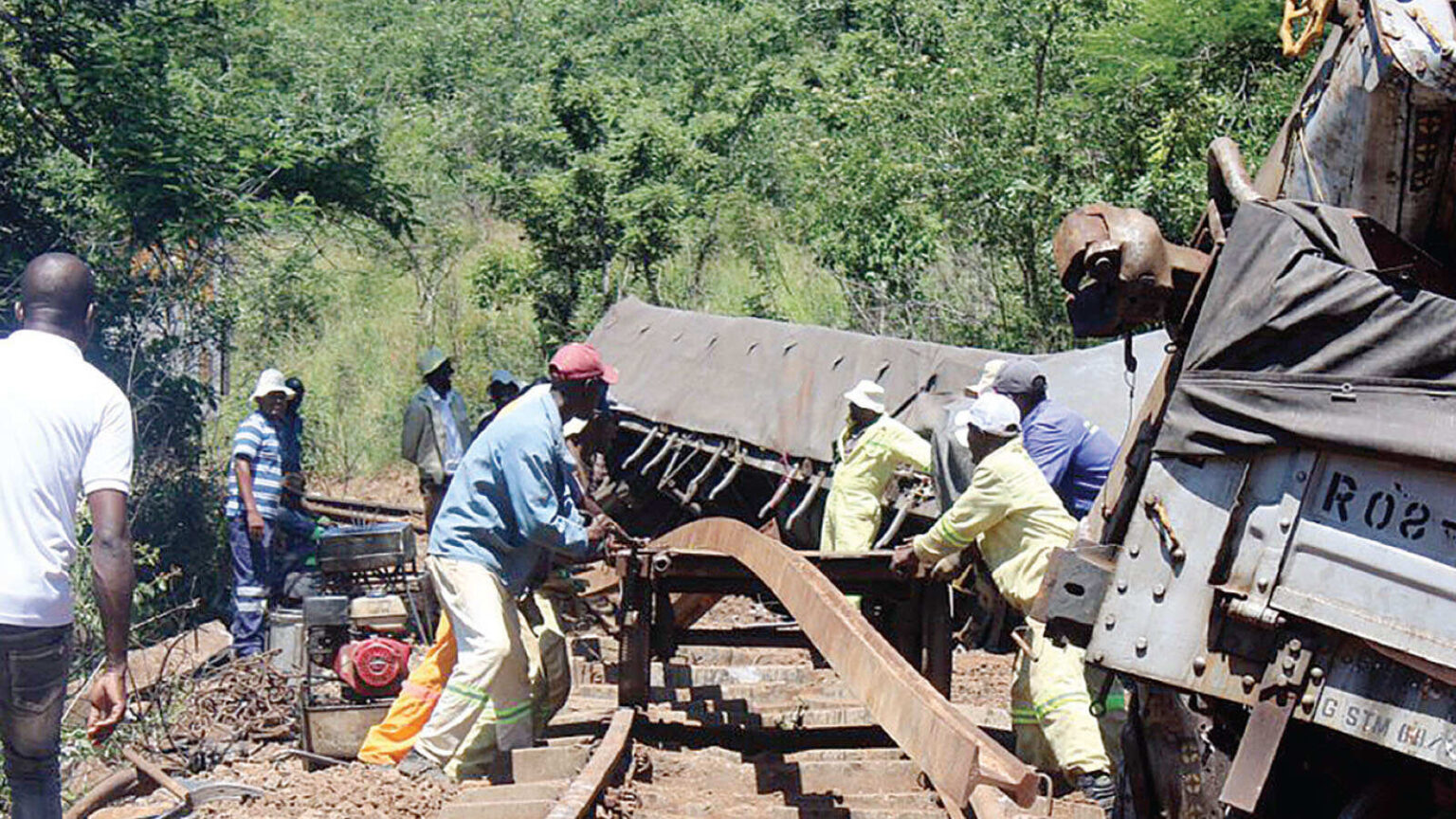

The challenge stems from decades of underinvestment and operational decline at the National Railways of Zimbabwe (NRZ).

Mr Nenzou also said relying on road transportation presented a significant challenge in meeting strict maritime regulations. Tight timeframes for loading vessels are difficult to achieve with road haulage, potentially causing exporters to miss loading targets. This can result in hefty charges for “unoccupied vessel space”, further squeezing profit margins for exporters.

Mr Linos Masimura, chairman of the Coal Producers Association, a lobby group for local coal miners, recently told this publication that export growth was being hampered by severe rail infrastructure issues. He said producers were being forced to rely on road transport, which is significantly more expensive than rail.

“We could actually do 10 times what we are doing had it not been for the logistical challenges,” he said.

The Government is, however, working on several measures to turn around the National Railways of Zimbabwe, focusing on financial restructuring, equipment refurbishment, and securing international investment and partnerships.

The NRZ has already secured a US$115 million loan from the African Export-Import Bank (Afreximbank) to acquire new modern locomotives. In September 2025, the NRZ signed a US$533 million deal with the China Railway International Group (Crig) to modernise and revitalise the ageing rail infrastructure.

Efforts to upgrade infrastructure include removing speed restrictions on tracks and beginning work on specific lines such as the Pachipanda–Mutare and Chikwalakwala routes, to increase operational efficiency.

Meanwhile, Zimbabwe is on course to meet its US$3,2 billion target following a rebound in global prices of platinum group metals (PGMs).

Despite a two-month temporary export suspension by Mimosa Mining Company pending a resolution on the 15 percent beneficiated material tax exemption applicable to Zimplats, and the halting of lithium exports by Bikita Minerals over subdued global prices, the firm market position of PGMs as well as lithium and chrome is expected to offset the setback and help the country meet its target.

MMCZ is a State-owned agency responsible for marketing the country’s minerals except for gold and silver.

PGMs global prices surged 54 percent year-to-date, while high-carbon ferrochrome, raw chrome and lithium increased by 24 percent, 22,6 percent and 7, 54 percent, respectively. PGMs, which registered the highest growth, contributed about 46 percent of total mineral sales.

“These rebounds position the corporation to meet its full-year export target, buoyed by strengthening global demand and renewed industrial activity in major consuming markets,” MMCZ general manager Dr Nomsa Moyo told journalists after the corporation’s annual general meeting last Friday.

In the first nine months of the year, export volume rose 45 percent above budget to reach 3,84 million tonnes. In value terms, exports totalled US$2,6 billion, marking a 0,7 percent increase compared to the same period in 2024.

PGMs remain the leading export earner, contributing over US$1,22 billion to total revenue, driven by improved processing and 54,5 percent growth in prices.

Ferrochrome exports, driven by steady Asian demand, reached 328 442 tonnes worth US$272,8 million, reflecting an eight percent increase in value. Coke exports also contributed US$142,6 million.

While lithium remains a fast-growing contributor, the sector faced global pricing headwinds.

Spodumene exports hit one million tonnes, recording a 27 percent volume surge, even as overall value dipped 11 percent to US$386,9 million amid soft global pricing.

Dr Moyo said during the remainder of 2025, MMCZ would focus on growth consolidation and strengthening value chains.

Granite exports, a relatively new commodity, are expected to grow at 1,9 to 2,4 percent annually through 2029, driven by demand in construction and design markets.

The diamond market is expected to stabilise following global production cuts and the completion of inventory adjustments related to lab-grown stones.

Dr Moyo said continued emphasis would be placed on beneficiation, contract realignment for PGMs, and domestic supply prioritisation for chrome and high-carbon ferrochrome.

The mining sector is the largest foreign currency earner in the country, and when gold exports — facilitated by Fidelity Printers and Refinery — are included, overall shipments reached US$4,53 billion over the nine months ending September.-herald