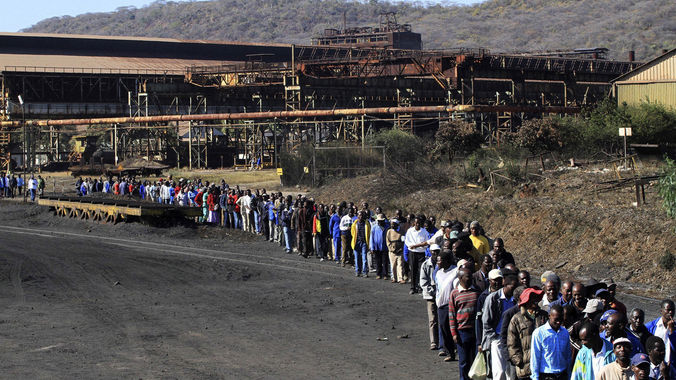

Zisco to start steel production in three years

STEEL production at the defunct Zimbabwe Iron and Steel Company (Zisco) is expected to resume in the next three years while limestone and iron ore mining operations will begin early next year.

Limestone and iron ore are critical raw materials used in the production of steel.

Before the closure of Zisco in 2008 largely due to mismanagement, the Redcliff-based steel manufacturing giant mined limestone and iron ore through its mining arm, Buchwa Iron and Mining Company (Bimco) in Redcliff and Buchwa in the Midlands Province.

In a recent interview, Zisco board chairman, Engineer Martin Manhuwa, said equipment to start limestone and iron ore mining ahead of the much-awaited resumption of operations had been procured.

At its peak in the 1990s, the largest integrated steel plant North of Limpopo, produced over one million tonnes of steel annually employing over 5 000 people directly.

“The plan is to commence mining of iron ore in Q1 of 2024 and so far we haven’t seen any obstacles.

“But steel plant operations take quite some time given that we are having an organic growth so, between two and three years from now, we should be having the old giant roaring again,” he said.

Last year, Zimbabwe’s largest mining house, Kuvimba Mining House (KMH) and Zisco, signed a management contract, a development viewed as a giant step towards reviving the mothballed steel plant.

The development comes after several attempts by the Government to revamp Zisco by seeking a strategic partner with a potential foreign investor hit a brick wall.

Among other potential investors that showed keen interest in Zisco include Essar Africa Holdings, a unit of India’s Essar Group having agreed to invest US$750 million into Zisco in 2011 during the era of the inclusive Government.

However, the deal collapsed in 2015.

In late 2019, negotiations for a US$1 billion revival deal between Zisco and R & F of China was signed, but the venture also collapsed.

Early last year, Cabinet approved the partnership between Zisco and KMH which has vast interest in gold, platinum, chrome, lithium and nickel to revive operations at the steel plant.

Against this background, KMH which does not own Zisco has proposed to invest up to US$1,3 billion into the steel plant over three years. KMH has engaged Strategen Company (SMS) of Germany as the lead consultancy to drive the revamping of the steel manufacturer.

Following the signing of the management contract, KMH has been doing on the ground undertaking all the preliminary activities that include planning and carrying out feasibility studies such as the type of steel to be produced when operations resume.

“Feasibility studies on Zisco have not been complete as yet, especially the steel plant feasibilities SMS of Germany is yet to establish their presence in the country to start feasibilities.

“However, mining pre-feasibilities are complete and we need now to come up with detailed geological and mining studies, which are in progress,” said Eng Manhuwa.

Under Zisco’s resuscitation which is divided into two segments — mining and the steel project, KMH will inject US$1 million into the project.

Since 2020, Kuvimba has been acquiring mothballed mining assets and industrial operations using internal resources with a view to give the entities a new lease of life.

The mining group controls the acquired entities either 100 percent or as a major shareholder.

Some of the entities it acquired include the Victoria Falls Stock Exchange-listed Bindura Nickel Corporation as well as Shamva, Jena, Sandawana, Tiger and Club, Globe and Phoenix mines, the new Great Dyke Investments platinum project under development in Darwendale and Zimbabwe Alloys (ZimAlloys).-ebusinessweekly