VFEX listing diversification to attract more investors

THE diversification of products on the Victoria Falls Stock Exchange (VFEX) is poised to attract new investors and offer existing ones more portfolio diversification opportunities, chief executive officer (CEO) Mr Justin Bgoni has noted.

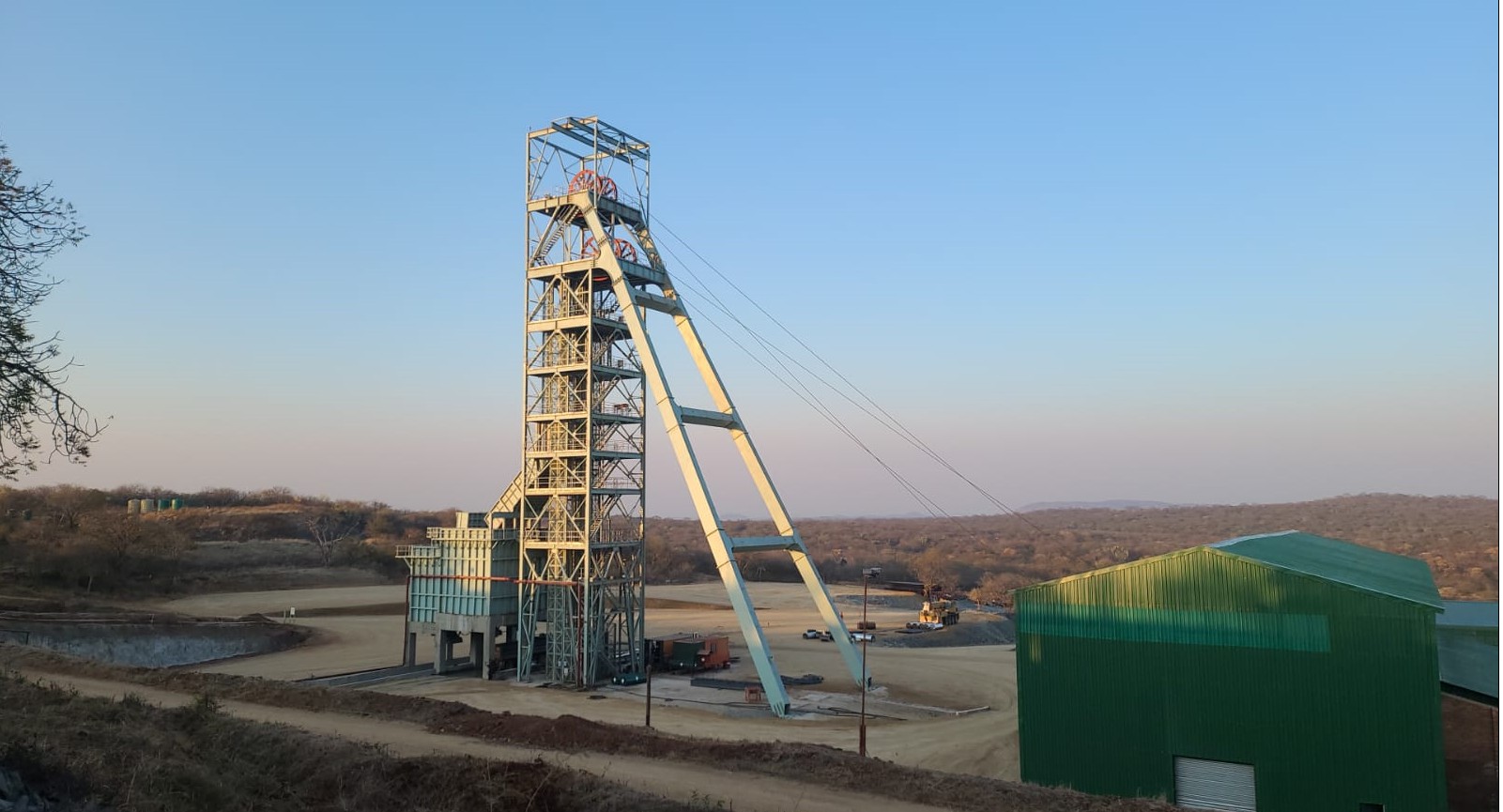

Since its establishment in October 2020, VFEX has seen listings from various sectors such as mining, financial services, tourism, hospitality and clothing.

Some of the companies listed include African Sun Limited, Axia Corporation Limited, Caledonia Mining Corporation, First Capital Bank, Innscor Africa and Edgars.

The US dollar-denominated exchange provides extended options for capital raising, including debt listing in foreign currency. VFEX has been said to offer several incentives and trading advantages compared to the Zimbabwe Stock Exchange (ZSE), which has been the pull factor for listings on the bourse.

VFEX bourse is a subsidiary of the ZSE, established to kick start the Offshore Financial Services Centre (OFSC) earmarked for the special economic zone in Victoria Falls.

It is part of efforts to attract global capital and restore foreign investor confidence in Zimbabwe’s capital markets and help companies raise capital in foreign currency.

Giving an operational and financial performance of the ZSE Group for the year ending 31 December 2023 under the annual report, Mr Bgoni said in the period under review, the ZSE experienced a period of general depression, evidenced by the significantly low number of trades and two de-listings on the bourse.

He said this is mostly attributable to the restrictions placed on the market through SI 103A of 2022, which effectively increased overall trading costs on the market.

“However, amidst this downturn, a positive development emerged with the listing of a new Real Estate Investment Trust named Revitus Property Opportunities Reit. This listing is indicative of the potential for growth within the Reits space, offering a glimmer of hope for future prospects,” said Mr Bgoni.

Turning to VFEX, he said the bourse experienced notable progress, with the addition of six new counters to its listings and improved trading levels.

The up-tick in activity on the VFEX reflects growing confidence and interest from the market participants in the platform, underscoring the increasing momentum and viability of the VFEX as a key player in the financial market.

He said as they navigate through challenging times, these developments serve as promising indicators of resilience and growth within our market.

“The diversification of products on VFEX is also expected to play a significant role in the exchange’s growth prospects. This increased product diversity will not only attract new investors but also provide existing ones with more opportunities to diversify their portfolios,” he added.

He said the ZSE’s outlook for the next trading year is positive, driven by the anticipated economic growth and increased product diversity on the VFEX. “We are confident that these factors will drive growth and increase investor confidence in the exchange.”

The turnover increased significantly, above inflation in the financial year under review compared to the prior year. The business achieved a 280 percent increase in turnover to $32,909 billion, with the major contributor being the listing fees, which saw a 512 percent boost from the prior year.

He said the increase in the number of listings on both exchanges, along with the increase in volume and value of trades on the VFEX, also played a role in the turnover increase.

Additionally, there were a significant number of requests from issuers to extend their publication dates, which boosted the document review fees.

Profits increased by 300 percent from $1,696 billion in the previous year to $6,786 billion in the current year. The increase was achieved as a result of cost-containment measures implemented during the financial year.

“Despite a 157 percent increase in operating costs due to exchange rate volatility, the business maintained its margins at 18 percent from the previous year, all made possible by the 280 percent increase in turnover.”

ZSE recorded a net foreign seller’s position of $46.6 billion in 2023 compared to $31.7 billion in 2022. Foreign investor participation declined, contributing seven of the total trades compared to 19 percent in 2022.-chronicle