Truworths: Shareholders value completely wiped out . . . Creditors to receive only 12 cents per dollar

The company’s near collapse is a cautionary tale of economic turbulence, unsustainable business practices and the relentless pressure of informal competition. The company, once a symbol of retail success, found itself teetering on the brink of liquidation, its fate hanging in the balance.

Business Writer

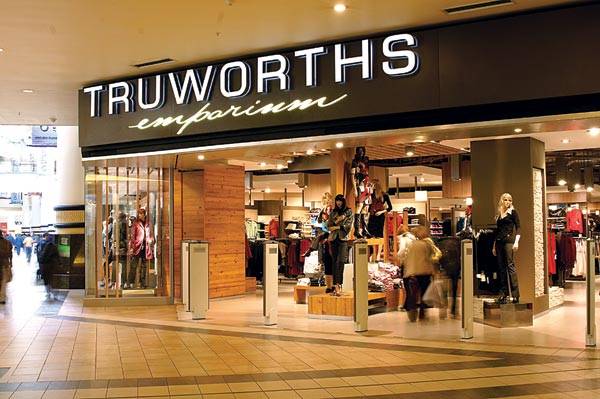

Truworths Zimbabwe Limited, once a clothing retail giant boasting 101 stores across the country, has narrowly escaped liquidation after creditors approved a corporate rescue plan. The plan, orchestrated by Corporate Rescue Practitioner (CRP) Dr. Oliver Mtasa, will see new investors take control of the struggling 67- year-old business, but at a significant cost to shareholders and creditors.

The group became financially hamstrung with the initial statement of affairs indicating a net liability position of US$994 321 as at 7 August 2024, but later ballooned to $2 064 128 after due diligence and including liabilities of US$1 043 660 relating to provision for severance pay to employees.

How did this all happen?

The company’s near collapse is a cautionary tale of economic turbulence, unsustainable business practices and the relentless pressure of informal competition. The company, once a symbol of retail success, found itself teetering on the brink of liquidation, its fate hanging in the balance.

“The group was technically insolvent,” revealed Dr Mtasa, painting a stark picture of the company’s financial woes. A core issue was the company’s reliance on credit sales. “85 percent of the group’s sales were on credit,” explained Dr Mtasa.

“There was inadequate liquidity to fund the stock and the debtors book, resulting in suboptimal sales, which negatively impacted cashflows and ultimately the business could not meet its cashflow performance.”

Essentially, Truworths was selling on credit but did not have the cash flow to sustain it.

Adding to the company’s woes: “The Group had been failing to fully cover its payroll obligations for the 16 months prior to Corporate Rescue,” Dr. Mtasa disclosed. This consistent failure to meet payroll obligations signaled deep-seated financial distress.

Arguably, the volatile economic climate in Zimbabwe played a significant role in Truworths’ downfall. “The prevailing volatile economic environment, owing to exchange rate and interest rate volatility,” Dr. Mtasa emphasised, “led to a series of devastating blows.”

He outlined a series of economic shocks that crippled the company including Statutory Instrument 33 of 2019, which converted all US$ balances to ZWL at 1:1, and resulted in the company’s balance sheet losing significant value.”

This sudden currency conversion decimated the company’s assets.

“In June 2022, a monetary policy statement effectively stopped any US$-based lending and increased the ZWL interest rate to circa 200 percent. The Group immediately stopped lending to customers (as the business model was no longer making sense), which resulted in suboptimal turnover and cashflows.” This policy shift effectively cut off a crucial part of Truworths’ business model.

“The capital raised through a rights issue in 2023 lost 50 percent of its USD value due to the 100 percent depreciation of the Zimbabwe Dollar between the opening and closing dates of the offer.”

Even attempts to raise capital were undermined by rampant currency depreciation.

“A reduction in the true value of products, which were literally valued under replacement cost.” This suggests that even the value of inventory was problematic.

Dr Mtasa also highlighted the impact of informal competition.

“There are laws that ban the importation of second-hand clothes, but the authorities do not enforce them. This has negatively impacted the industry, as the informal sector is prone to smuggling and dumping goods, which results in selling these products at lower costs than those produced formally. Competition from the informal sector is not subject to similar regulatory compliance requirements.”

This unfair competition put immense pressure on Truworths’ ability to compete. Finally, Dr Mtasa explained the challenges with the supply chain.

“The diminishing supplier base in the country left the Group with no option but to import raw materials and finished products, which requires upfront funding in USD and longer delivery times. On the other hand, the Group’s credit sales resulted in prolonged cash flow cycles which could not be funded, resulting in branch closures and understocking.”

This combination of factors, from supply chain disruptions to funding difficulties, created a perfect storm for Truworths, ultimately leading to its near collapse.

The rescue deal: A bitter pill for some

The approved plan involves a US$4 million injection from a consortium led by local manufacturer, Valfin Investments and include First Mutual Microfinance. This capital will be used to fund the business US$2 million, purchase of merchandise and operating costs US$2 million. Debentures worth US$1 067 172 will also be issued.

Unsecured creditors will receive a mere 12 cents for every dollar owed, paid out through debentures over 24 months with an 8 percent annual interest rate.

Existing shareholders, including major players like Truworths International (34.39 percent) and Mega Market (33.81 percent), will see their shares effectively wiped out, receiving a symbolic $1 total for their holdings. The company will subsequently delist from the Zimbabwe Stock Exchange.

Over 1 965 employees, owed a combined $1,97 million in back pay and severance, will be rehired under new contracts.

In a separate arrangement, supervisory staff will take ownership of Bravette Manufacturing through an employee trust funded by company assets.

A story of losers and winners

The rescue plan paints a clear picture of winners and losers with shareholders and creditors the hardest hit. Shareholders will lose their entire investment while creditors face an 88 percent loss. Trade creditors, such as Mega Market Pvt Ltd (owed $210,137) and Stylepilot Enterprises (owed $173,853), will recover only a fraction of their dues.

Employees, while retaining their jobs, will forfeit pre-rescue entitlements.

On the other hand, the Valfin consortium emerges as the primary beneficiary, gaining control of Truworths’ retail network and manufacturing assets. First Mutual Microfinance will manage the debtors’ book, providing much-needed liquidity. Employees, although under new contracts, retain their jobs, and Bravette’s staff gain ownership of the factory.

Averting a worse fate

Dr. Mtasa emphasised that liquidation would have resulted in zero returns for creditors and widespread job losses.

“This plan offers a lifeline,” he stated. “Without it, Zimbabwe would lose a long-standing retailer, and creditors would receive nothing.” Financial projections suggest Truworths could return to profitability by 2027, with projected revenue reaching $6.5 million.

Truworths’ decline reflects the broader challenges facing Zimbabwe’s apparel industry, exacerbated by hyperinflation, currency volatility, and competition from smuggled goods. The success of the rescue plan hinges on stringent cost controls, debt restructuring and Valfin’s manufacturing expertise to revitalise local production.

The road ahead

The CRP will oversee the transition, with debenture payments commencing in 2025. The focus now shifts to Valfin’s ability to stabilise Truworths and whether the retailer can reclaim its former prominence in a still-unpredictable economic environment.-ebsienssweekl