Truworths on the brink, can it be saved?

Listed firm Truworths has been placed under corporate rescue along with its subsidiaries namely, Topic Stores, and Bravette Manufacturing Company, according to Crowe Zimbabwe in a press statement.

A corporate rescue refers to a process of saving a financially distressed company from bankruptcy with the goal to restructure the company’s finances and operations, allowing it to continue as a going concern.

Truworths has been hit by inflationary pressures and tight liquidity in the economy, which resulted in depressed demand due to waning consumer spending.

According to Truworths’ third quarter trading update of 2022, “Low disposable incomes due to inflation had a negative impact on the volumes sold, with customers resorting to buying products in the unregulated informal market at prices which the business could not compete against.”

In the group’s full year financial results for the year ending July 9, 2023, it highlights that Zimbabwe’s clothing retail business faces stiff competition from the informal traders selling imported clothes from neighbouring countries at low prices rendering local products uncompetitive.

This led to the discontinuation of credit sales in local currency, contributing to a 45 percent decline in units sold as the trading environment remained challenging.

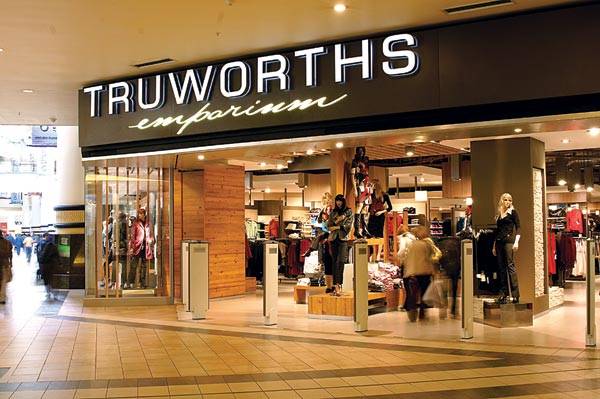

Truworths is a retailer of fashion apparel and related merchandise that offers perfumes, bags, shoes, homeware products, clothing and footwear for ladies, men, teenagers and kids.

The notice says the company will remain listed on Zimbabwe Stock Exchange (ZSE) under voluntary suspension up until exit from corporate rescue.

“During the corporate rescue proceedings as provided by section 126 of the Act, no legal proceeding, including enforcement action, against the company, or in relation to any property belonging to the company, or lawfully in its possession, may be commenced or proceeded with in any form without the authority of the Corporate Rescue Practitioner,” according to the notice.

The first meeting of creditors of the company will be held on August 28, 2024 at 9 am at the Master’s Offices, Court A, corner Sam Nujoma (Second Street) and Herbert Chitepo Avenue in Harare.

Financial Consultant Mr Rufaro Hozheri said Truworths can be saved if they employ the right strategies.

He said Truworths is similar to Edgars but only needed capital injection and a change in strategy.

“I do not think this is the end of the road for Truworths, if you look at its closest competitor in the Zimbabwe market, which is Edgars, which is implementing a raft of strategies to ensure that it can compete. Perhaps this is what Truworths might want to start to think of, because one thing for sure, the operating environment in Zimbabwe is different from 20-30 years ago.

“We now have the second-hand clothing industry, which is bigger than before snatching its original market, which is the working class. So, there is a lot needed in order to snatch that market back.

“I also think there might be a need for a capital injection so they might need to do a rights issue so that they can generate new capital, increase their manufacturing so that they can compete,” said Hozheri.

He said pricing needs to be a key factor in their production line to ensure competitiveness because second-hand clothing traders are selling at very minimal prices.

“We are talking about US$5, US$10 or even lower and also the cheaper imports that are coming from Zambia, South Africa, all this is their competition.”

Another Analyst Mr Sylvester Mupanduki said Truworths was beyond redemption, but its brand still holds value.

“The business was run down by its own management and trying to bring it back in this environment will be very challenging.

“These are two different things, the brand and the business as a going concern. The business cannot be rescued but the brand can.

“Any potential buyer would essentially be purchasing a recognisable brand with foreign roots, but little else.”-ebsinessweekl