Truworths gets nod to raise ZWL$2,2 billion

LISTED clothing retailer Truworths shareholders have approved a proposed Renounceable Rights Offer of 384 067 512 shares that seeks to raise an estimated ZWL$2,2 billion additional working capital.

The authorisation to proceed with the Renounceable Rights Offer was granted at the Extraordinary General meeting held on 4 July.

A renounceable right is an offer issued by a corporation to shareholders to buy more shares of the company’s stock, usually at a discount.

In an update, shareholders approved capital raising by way of a Renounceable Rights Offer and the Underwriter and Underwriter’s fees.

In a recent circular to shareholders, the firm said in order to sustain the viability of the business, the Board has decided to raise additional capital into the business so as to “increase working capital funding at a sustainable cost in light of the high-interest rate environment, reduced borrowings, open new format Truworths Chain stores and improve the product assortment.”

The listed entity said if the Renounceable Rights Offer is not implemented, the company will face severe cash flow constraints, high finance costs and reduced working capital.

The Renounceable Rights Offer is also subject to an approval from the Zimbabwe Stock Exchange (ZSE), shareholders and approval of the Transaction by the Exchange Control department at the Reserve Bank of Zimbabwe for the issuance of shares to non-resident shareholders.

Based on the circular to shareholders, the Board has engaged an existing shareholder, Mega Market (Private) Limited to underwrite the Renounceable Rights Offer.

Mega Market has a shareholding in Truworths of 28,66 percent of the total issued share capital.

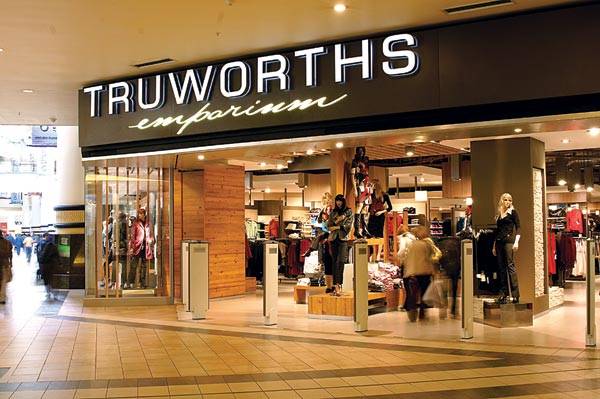

Truworths Limited is a company incorporated and domiciled in Zimbabwe whose shares are publicly traded.

Its core business is the retailing of clothing, footwear, textiles and accessories.

As at April 2023 the Group had a total of 46 stores nationwide, with over 11 577 square metres of store space.-chronicl.zw