Starafricacorporation speak on sugar import duty

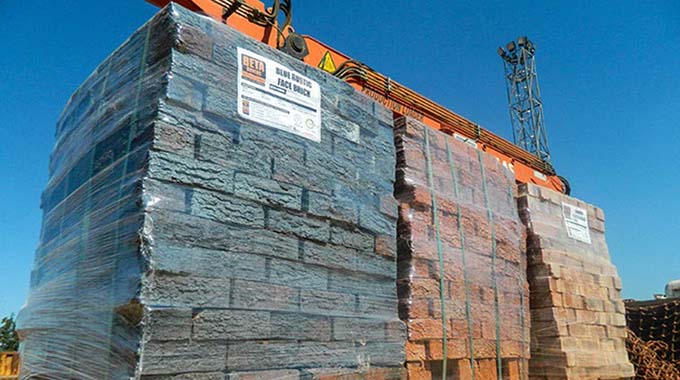

A sugar-producing firm -Starafricacorporation has urged the Government to restore, import duty on imported sugar saying that the move will help to develop and grow the local sugar industry.

In May, the Government lifted all restrictions on the importation of basic commodities to boost market supplies following a spate of price increases linked to wild parallel market rates, which led to the erosion of people’s incomes and is constraining aggregate demand for goods and services.

Sugar is one of the goods, which was put under duty-free importation.

In a statement accompanying the unaudited abridged financial results for the year ended March 2023, Starafricacorporation board chairman, Mr Rungamo Mbire said there is a need to restore import duty to promote growth for local industries.

“The company looks forward to the Government reinstating duty on imported sugar, a development which will impact positively on the local sugar industry,” said Mr Mbire.

“The company will continue to tighten its cost-mitigation measures in an effort to improve the operating profitability of both the refinery and the sugar specialties unit.”

Mr Mbire’s views dovetail with Buy Zimbabwe’s continuous concern over the proliferation of unfortified sugar imports in the market, a development that is exerting undue competition with local products.

Meanwhile, the sugar firm posted a 30 percent increase in turnover in the year under review from $38,5 billion in the prior year to $50, 1billion.

The improvement was largely attributable to strong demand for all the group’s products during the year under review.

“However, the group’s operating profit shrunk by 93 percent, from $5, 0 billion in the prior year to $0,4 billion. The lower operating profit was a direct result of increases in raw sugar prices and operating costs in real terms.

“Increasing global inflationary pressures have resulted in a spike in the costs of imported chemicals, packaging and refinery spares.”

He said in historical terms, revenue increased by 317 percent, from $10,2 billion recorded in the prior year to $42,5 billion, while operating profit increased by 26 percent, from $1,7 billion to $2,2 billion.

Mr Mbire added: “In inflation-adjusted terms, revenue performance for properties business improved significantly with $337, 5 million of rental income being recorded, compared with $162, 2 million in the prior year. The unit has recovered significantly from the previous year, which was negatively impacted by the Covid-19 pandemic that reduced tenants’ ability to generate income and meet their rental obligations.”-chronicle