‘New $50 note won’t stoke inflation’

The introduction of new $50 bills by the Reserve Bank of Zimbabwe today is essentially meant for transactional convenience by members of the public and will not stoke inflationary pressures since they do not add to the country’s reserve money, observers have concurred.

This comes as the RBZ has introduced $50 notes, which will come into circulation with effect from today.

Economist and Monetary Policy Committee (MPC) member Persistence Gwanyanya, said there is no fundamental basis for any price increases.

“The global standard is that a country’s largest denomination should be equivalent to US$20. However, in Africa the common range is US$5-20. This means by global standards our largest denomination should be around $425-1 700 for transactional convenience.

“However, because of our historical experience of hyperinflation, on account of excessive monetary expansion, which was supported by higher cash denomination, RBZ is now overly cautious about higher denominations.

“What would be more interesting for the ordinary person to know is that the increase in cash denomination is not going to be associated with the increase in money supply,” said Mr Gwanyanya.

“The Monetary Policy Committee actually reduced its quarterly reserve money target from 22,5 percent to 20 percent to support its disinflation programme.

“I know the temptation by our speculative, arbitrageurs and rent seekers seeking to increase prices as a reaction to the introduction of the new denomination, but the message out there is very clear. There is not going to be an increase in money supply to support price increase.”

According to the Zimbabwe National Statistics Agency, the country’s year on year inflation rate for the month of June 2021 slowed to 106,64 percent from 161,9 percent in May, as both fiscal and monetary initiatives to contain inflation continue to yield positive results.

According to latest central bank data, the country’s reserve money increased by $602,35 million to $24,45 billion, as at week ending June 25, 2021, from $23,85 billion recorded in the previous week, attributable “increases of $323,06 million and $277,23 million in required reserves and banks’ liquidity (RGTS balances) at the Reserve Bank, respectively.”

Said National Business Council of Zimbabwe president Langton Mabhanga: “Given the current stability, the new note will help with access to cash for those that largely deal in cash transactions. I expect that those in the horticulture industry, for example, are particularly happy with this development.

“But we continue to implore people to continue using plastic money. And we don’t expect the new note to flow to the parallel market or otherwise contribute to illicit activities given all the parameters that are in place and the discipline that we have seen in the market,” he said.

Confederation of Zimbabwe Retailers (CZR) president Denford Mutashu said: “It’s a welcome development and all we need is to work harder to get cash to circulate within formal channels otherwise illegal foreign currency dealers celebrate more than formal business who are failing to access cash anyway.

“The bulk of cash is being intercepted by illegal money changers who have increased in numbers and applying various tactics to evade arrest. As a country, I don’t think we do not have capacity to deal with this vice.

“Our porous banking institutions have not helped matters as these cash shenanigans have continued unabated. It boggles the mind that illegal forex traders are using many accounts held with different banks without being noticed. The same way we dealt with mobile money transfers should be applied on these bulk wire transfers funding illegal forex trading.”

Treasury has given legal effect to the issuance of the new notes by promulgating Statutory Instrument 196 of 2021.

According to the apex bank, $360 million worth of the new $50 notes will be issued.

Said RBZ Governor Dr John Mangudya: “The Bank shall release $360 million through normal banking channels and banks are expected to fund their respective accounts held at the Reserve Bank and collected the cash from July 7 2021,” reads part of the statement.

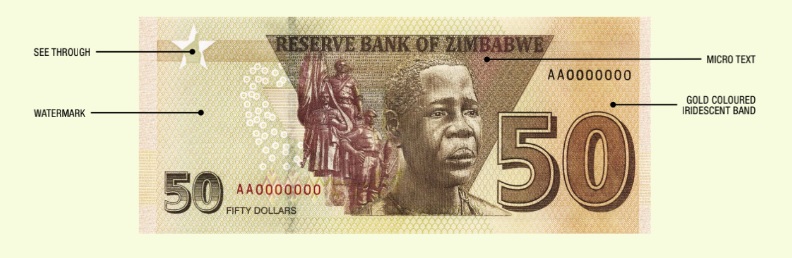

In terms of SI-196 of 2021, the design of the $50 banknote shall be as follows:

(a) on the front side the dominant feature shall be the logo of the Reserve Bank of Zimbabwe (three balancing rocks), with the visually impaired recognition feature to the left, latent image showing the denomination, windowed security strip inscribed “50” with colour shift from red to green, watermark with highlighted inscription “RBZ” and see-through of Zimbabwe Bird looking to the left in perfect register, as secondary features; and

(b) on the back side there shall be an impression of the Tomb of the Unknown Soldier and the motif of Mbuya Nehanda, gold coloured iridescent band showing the denomination of the note and see-through of Zimbabwe Bird looking to the right.-herald.cl.zw