I&DBZ charts course towards financial strength

THE Infrastructure and Development Bank of Zimbabwe (I&DBZ) is strategically charting its course towards financial strength and impact, eyeing to achieve a balance sheet capacity of US$500 million in the medium term and an even more robust position, targeting a balance sheet capacity of US$1 billion by 2030 to effectively execute its mandate.

The envisioned capacity reflects the bank’s ability to manage assets, liabilities and capital effectively and the ambitious goal aligns with their mandate to drive development and infrastructure projects.

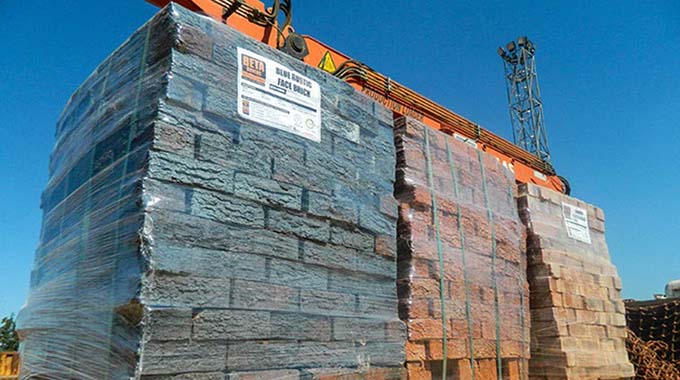

Formerly known as the Infrastructure Development Bank of Zimbabwe, the rebranded I&DBZ says it is committed to the reduction of the country’s housing backlog through various housing development projects.

The projects also include students and staff accommodation initiatives.

Working with other Government departments and agencies, the bank also supports players in the infrastructure value chain including in critical areas such as irrigation development and renewable energy projects.

The Bank said in recognition of the importance of infrastructure to national development and the attainment of Vision 2030, it continues with its transformational and retooling agenda to become a development finance institution (DFI) of scale by 2030.

“The Bank is engaged with its shareholders on foundational capitalisation initiatives that are key in anchoring the implementation of its Recapitalisation Programme which targets a capitalisation level of US$500 million in the medium term and US$1 billion by 2030,” said board chairman Dr Kupukile Mlambo.

Dr Mlambo noted that in order to effectively execute its mandate, the bank will need to leverage a stronger balance sheet as it pursues project financing, strategic partnerships, public private partnerships and climate financing initiatives.

To that end, the bank is in the final stages of establishing a dedicated climate finance facility (CFF), whose aim is to mobilise resources for financing green projects.

“To crowd in investors, the Government has committed to inject US$3 million as seed capital into the CFF and in 2024, the bank will continue to strengthen its climate finance capabilities to harness available funding for infrastructure development,” said Dr Mlambo.

In the period under review, the Bank’s Chief executive Mr Zondo Sakala said the Government and the Reserve Bank of Zimbabwe injected US$1,97 million towards capitalisation.

The bank last year got a total of US$5,82 million from the market to fund more than 10 infrastructure projects countrywide.

It also continues to support players in the infrastructure value chain (IVC). Disbursements towards IVC projects reached US$5,49 million with the bank’s loan book closing the year at US$5,46 million.

The bank has been visible in implementing various projects in Matabeleland.

For instance, last year it completed the Bulawayo Student Accommodation Complex (BSAC) which will house more than 1 000 tertiary institution students.

The multi-purpose three-block flats complex dubbed “Bulawayo Students City” has 516 rooms, 264 for males and 252 for females with a capacity to accommodate 1 032 students.

The project is expected to alleviate accommodation shortage for tertiary institution students in Bulawayo and students are expected to move in before the end of the year.

The facility is self-contained and has fast food outlets, shops, salons and sporting facilities.

The bank is working on a similar project in Matabeleland North province, the Lupane Students Accommodation Complex (LUSAC) estimated to cost US$19,8 million.

It is also heavily involved in the development of Willsgrove Park Phase 2 housing project through a Joint Venture with Whitepear Farming Company (Private) Limited.-chronicle