African mass markets provide better solutions to opportunity costs

IF there were no mass markets, most African farmers would not be able to benefit from the seasonal nature of most production practices.

Smallholder grain producers often ask themselves questions like: Which is better earning US$240 from a tonne of oil seeds in the mass markets immediately and using that income to invest in seasonal horticulture or wait for more than three months to be paid US$500 a tonne?

Being awake to the danger of missing opportunities for re-investing in their enterprises if they wait for a payment that comes through formal channels like banks after several months, most smallholder farmers would rather get less cash immediately and reinvest in other low hanging opportunities.

These are some of the dynamics that African policymakers do not understand.

Keeping money flowing within value chains

Time is more important than money for many smallholder farmers who have become accustomed to techniques for keeping money flowing within value chains unlike keeping money in a bank where the money is consumed by bank charges and inflation.

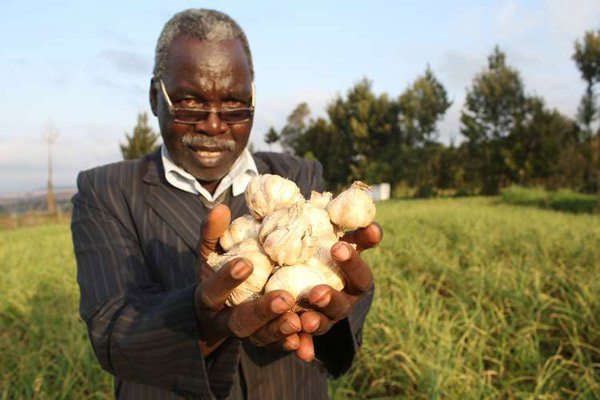

Due to low barriers to entry, horticulture has become one of the sources of opportunities for African smallholders.

Realising that horticulture is a perishable sector whose information is also highly perishable, farmers are aware that information has to be on their finger-tips. This is different from commodities like small grains, groundnuts and maize which can be stored while market decisions are being negotiated.

That is why policymakers and development agencies should assist farmers by developing appropriate data gathering tools and use ICTs to professionalise, modernise and enhance extension services for the benefit of farmers.

Value of appropriate farmer characterisation

To reduce opportunity costs, African policymakers should not only assess the capacity of farmers on the basis of access or ownership of natural resources like land, water and others.

Farmers have to be classified according to capacity and potential to produce different horticultural crops. It becomes possible to build a case for opening specific markets.

For instance, a private investor interested in producing peas or small grains cannot make informed decisions based on the availability of natural resources alone.

There are farmers who have natural resources but have reached their ceiling and no longer have the energy to experiment with new, sophisticated crops.

Potential capacity should inform opening of new markets and conditions under which consistent production can take place.

Some farmers may be keen to produce but lack knowledge while others cannot gauge the suitability of their equipment for producing different crops.

Unfortunately, in most African countries, no one is responsible for consolidating information from production to the market. Government extension workers are more on the field.

There are no systems for gathering, processing and sharing information and knowledge timely along the value chain.

Disorganised production, transportation and marketing make it difficult to track the value chains and show where different commodities are going and why.

Gluts, shortages and inconsistent quality become the order of the day as well as lack of financial systems.

All these details need clarity on who is responsible for consolidating information and knowledge in the emerging markets.

Minimising all kinds of losses

In most African agriculture-driven economies, economic and physical losses are increasing as commodities fetch prices below their potential economic value due to gluts.

For instance, at one time a box of tomatoes goes for US$10, but sometimes the price goes down to US$1, making it difficult for farmers to plan.

Zimbabwe has more than 100 agricultural markets ranging from district, provincial, urban to roadside markets.

Regional markets like Mozambique, Malawi, Zambia, Botswana and South Africa are not being properly tracked in terms of what is going in and out.

Evidence regarding how much is being produced, consumed and traded at various levels of local and regional markets is also limited.

Investors need to know what equipment to put in place.

While processing companies, fast food outlets and food chain stores are other forms of markets, dilapidated infrastructure remains a key feature of African mass markets yet these institutions handle more than 70% of the food produced by smallholder farmers.

There is need for systems for capturing and tracking what is coming in and going out of informal markets.

This can generate statistics showing supply and demand corridors which can inform the building of a strong food system.

Besides revealing opportunities, tracking the flow of commodities enables profiling the performance of farmers, traders, vendors, transporters and many other actors.-newsday