Address challenges in mining sector — stockbroking firms

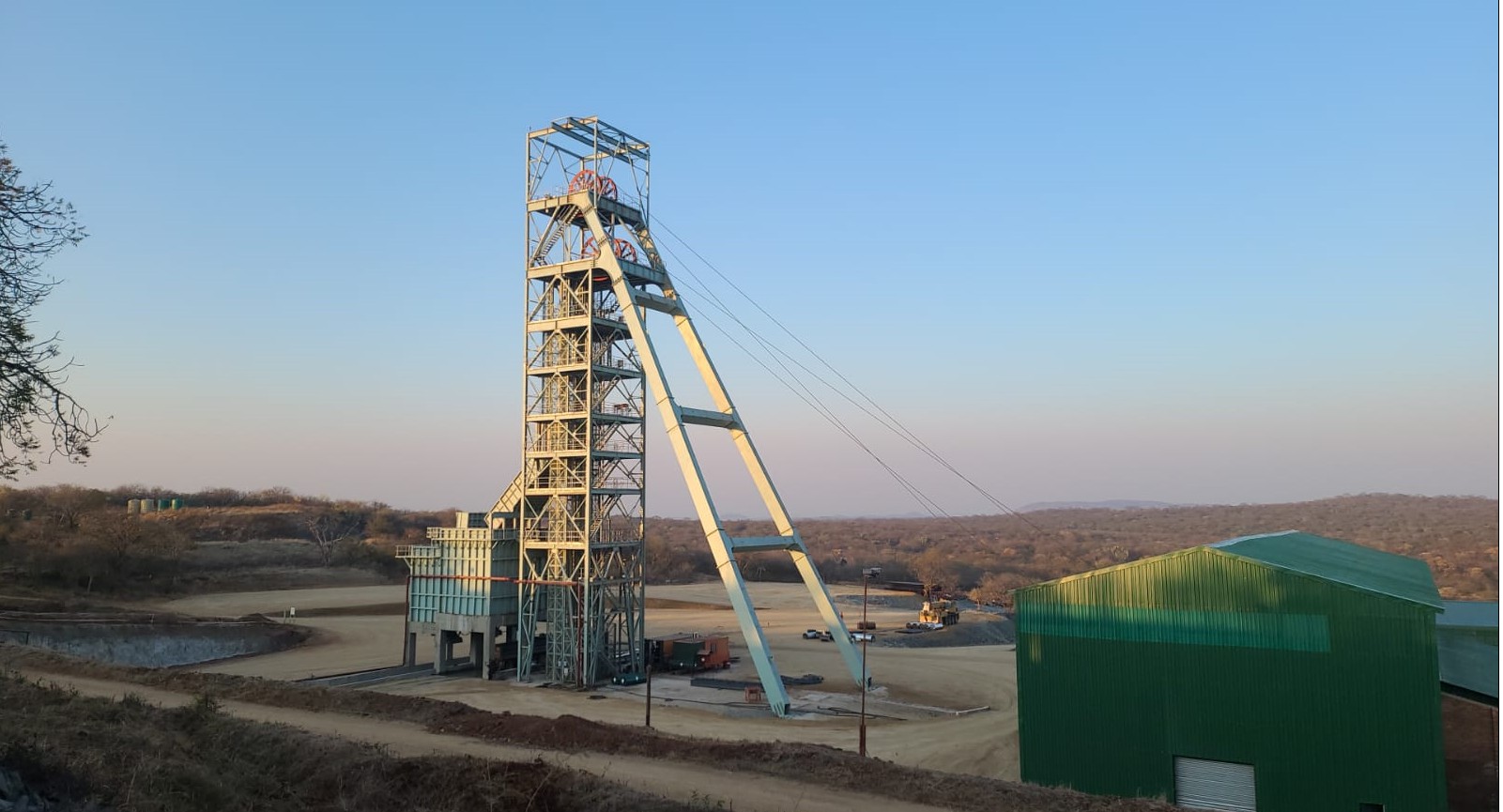

Zimbabwe can realise full potential of its mining industry if it addresses challenges such as infrastructure issues, inadequate power supply and regulatory uncertainties, Stockbroking Firm, Fincent Securities has said.

This comes as the country’s mining sector plays a very significant role in the development of the country as it has continued to bring much-needed income into the country. Mining accounts for about 12 percent of Zimbabwe’s Gross Domestic Product (GDP), according to a May 2022 estimate by the Standard Bank Group.

It is also the country’s largest export earner having contributed 75,8 percent of the US$7,41 billion export earnings in 2022.

But to improve on this, Government also needs to finalise the amendments to the Mines and Minerals Act and the Gold Trade Act and Precious Stones Act, said Fincent.

Other areas where Government has to engage relevant stakeholders to come up with win-win solutions include export tax on minerals, on beneficiated PGM’s, royalties and mining fees and charges, among others. According to Fincent; “Capital constraints and policy shifts remain the main downside risks for the sector and beneficiation remains a key issue hindering earnings growth”.

Despite the challenges, Fincent sees the mining sector as poised to remain “a crucial pillar of Zimbabwe’s economy, serving as a vital source of export earnings”.

“This economic resilience is attributed to the presence of key minerals such as gold, platinum and the recently emerging lithium, which are expected to make substantial contributions to the country’s foreign exchange reserves,” the Stockbroking firm said in its Zimbabwe Mining Sector Report released this week.

Fincent said as the country moves forward, it is anticipated that the Government will continue its efforts to revise policies and foster constructive engagement with stakeholders.

“These actions aim to establish a conducive environment that welcomes both foreign and local investors, further bolstering the mining sector’s growth and its contributions to Zimbabwe’s economic stability.”

Turning to investment opportunities, Fincent said producers of critical minerals (such as lithium, cobalt, copper, aluminum, graphite, and nickel) find themselves in an especially advantageous position.

“This advantage stems from market forecasts that anticipate a substantial shortfall in the supply of essential resources such as lithium and platinum compared to the growing demand for these materials over the next decade.

“Consequently, this scenario presents a significant and promising opportunity for rare earth mineral producers to meet this burgeoning demand and contribute to the shift towards sustainability,” the securities dealing firm said.

This comes as Fitch Ratings has revised its outlook for the global mining sector, shifting from a previously deteriorating stance to a more neutral one.

This change, according to Fincent, is attributed to several factors, including an upswing in demand from China following an earlier reopening of its economy.

“Additionally, the sector benefits from a more resilient global GDP growth projection for 2023 and a better balance between supply and demand for key mining commodities.

“The renewed demand emanating from China provides substantial support for Fitch Ratings’ more positive assessment of the mining sector’s outlook,” said Fincent.-ebusinessweekly