O’mari hits 1.3 million users, driving Old Mutual’s Zimbabwe growth

Old Mutual Limited is seeing significant success in its Zimbabwean operations, particularly with the rapid adoption of its new fintech platform, O’mari.

The company announced that O’mari has acquired 1.3 million customers since its launch, highlighting the platform’s strong appeal in the market.

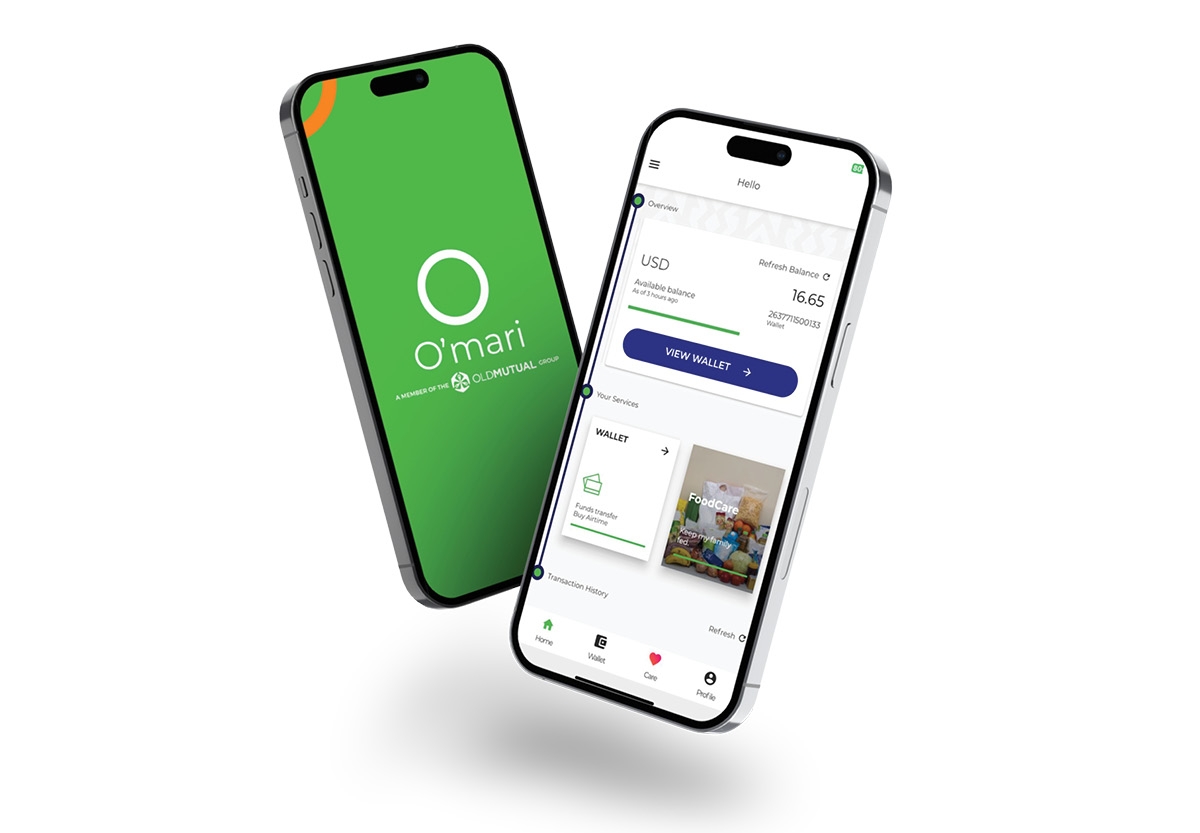

Launched in May 2023, O’mari provides mobile money services, insurtech, investech, digital lending, e-commerce, payments, and digital products and services for the retail mass market.

Products included the O’mari mobile wallet, O’mari FoodCare, O’mari SchoolCare and O’mari HealthCare, micro insurance solutions that are underwritten by Old Mutual Zimbabwe Life Assurance Company.

The mobile wallet is an interoperable mobile money solution that allows customers to register on all three mobile networks in Zimbabwe, namely Econet, NetOne and Telecel.

The O’mari mobile wallet is a dual currency wallet that allows customers to transact in both US$ and ZWL$.

O’mari customers are also able to send money to any bank or mobile wallet, buy airtime for any network, make merchant and bill payments for billers such as Old Mutual, ZESA, TelOne, Liquid Home and many others.

“We see an opportunity to use O’mari as a wallet on which other services can be offered and scaling to other markets,” Old Mutual stated, indicating its ambition to expand the platform’s functionality and geographical reach.

This demonstrates the Group’s confidence in the Zimbabwean market and its commitment to driving financial inclusion through innovative digital solutions.

Furthermore, Old Mutual emphasized its broader strategy of empowering individuals and small businesses through financial education and fintech solutions.

Initiatives like the award-winning Moneyversity+, a digital platform for financial education, and O’mari in Zimbabwe are central to this strategy. The company also highlighted the launch of OM Bank as a key driver of its financial wellness proposition, aiming to provide guidance and education to promote financial health.

The Group’s Africa Regions, including Zimbabwe, continue to be a significant contributor to its overall earnings, with all segments delivering strong results. This positive performance reinforces the importance of the African market to Old Mutual’s growth strategy.

Financial Performance and Dividends

Beyond its operational success in Zimbabwe, Old Mutual Limited also reported solid financial results for the year. The Group delivered a 4 percent growth in results from operations, with a 7 percent increase in results from operations per share. Excluding investments in new growth initiatives, the growth was even stronger, at 10 percent, driven by exceptional underwriting results and strong contributions from Wealth Management and Old Mutual Investments.

The company’s cash generation remained robust, with R10.5 billion remitted from subsidiaries, representing 158 percent of adjusted headline earnings. This strong cash flow allowed for the payment of special dividends, including R2 billion from Old Mutual Life Assurance Company (South Africa) Limited (OMLACSA), R1.5 billion from Old Mutual Capital Holding, and R1 billion from Old Mutual Africa Regions.

In line with its dividend policy, the Board declared a final dividend of 52 cents per share, bringing the total dividends for 2024 to 86 cents per share. This represents a 6 percent growth and a dividend cover of 1.6 times.

Old Mutual’s balance sheet remains strong, with a Group shareholder solvency ratio of 182 percent, within its target range. OMLACSA’s regulatory solvency ratio was also robust at 187 percent. The company’s return on net asset value continued to trend upwards, reaching 12.7 percent, reflecting operating earnings growth and higher shareholder investment returns. Excluding new growth initiatives, the return on net asset value improved to 15.6 percent.-ebsinessweekl