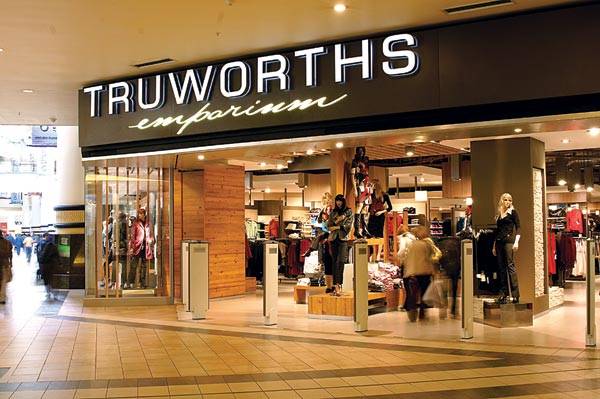

Truworths volumes drop

LISTED clothing retailer, Truworths, says units sold declined by 45 percent in half the year ended January 8, 2023 due to the suspension of credit from 1 July 2022 and in formalisation of the economy, which has resulted in the influx of illegal imports.

Credit was suspended when the Bank Policy Rate was increased to 200 percent per annum.

According to the firm’s financial results, the 200 percent interest rates were not viable for the business to finance the credit.

“In addition, it was not affordable for our customers to service their account obligations at rates in excess of 200 percent per annum,” it noted.

At the onset of hyper-inflationary conditions, the business reduced its exposure to credit sales because of the loss of value of the debtors’ book.

It said the sales value performance was negatively affected by price controls enforced by the Financial Intelligence Unit (FID) through the use of the official (exchange rate) in the sale of merchandise.

The update indicates that the business maintained a competitive US dollar price in order to be able to compete on a US dollar basis, translating the US dollar price to ZWL price at the auction rate resulted in the uneconomic ZWL prices and loss of value.

Money – Image taken from Pixabay

Truworths also cited the informalisation of the economy, which has resulted in illegal imports selling at below manufacturing costs saying it could not compete against these.

On credit management, it noted that the debtors’ book declined as credit sales were stopped in July 2022 due to the increase in the prime interest rate to 200 percent per annum, which made credit sales unviable for the business.-chronicle