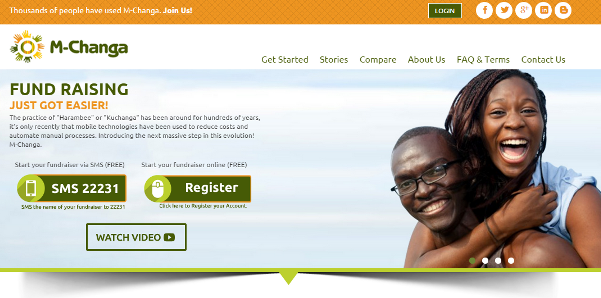

M-Changa: Modernising traditional fundraising in Kenya

The philosophy lives on today. In fact most Kenyan adults participate in several fundraisers every year to raise money for everything including weddings, funerals, school fees and medical bills. Now a local tech start-up is adding a touch of modernity to the age-old practice.

Traditional fundraising involves face-to-face meetings, but are expensive and a hassle to organise due to distances between friends and family expected to participate. Transparency is also often lacking.

In 2012, Kenyan-American entrepreneur Kyai Mullei and American David Mark co-founded fundraising tool M-Changa. Mullei says he was motivated by personal frustrations as a committee member in his extended family’s fundraisers. He wanted to make fundraising quick, easy, cheap and transparent.

“There was a lack of transparency for both beneficiary and donor. If, say, I gave $5 I really did not know if the money would reach the beneficiary. The ultimate beneficiary was in turn unaware of what was going on until the end when the committee had collected all the funds.”

Mullei explains a lack of transparency can also affect the likelihood of potential donors participating in a fundraiser and how much they give.

“I would cap how much I give just because I don’t have proper information, not because the beneficiary doesn’t deserve it. If we make fundraiser management transparent, easy, efficient and cheaper than normal, then we should see more successful fundraisers.”

M-Changa now has 28,000 users. Fundraisers have used the platform to mobilise more than Ksh.30m (about $307,000). Mullei says most of these funds were raised in the last eight months following introductions of new features gleaned from customer feedback.

Users can start a fundraiser on the M-Changa website, or by sending an SMS to a five-digit number stating the name of the fundraiser. They then give their name, fundraiser details and invite donors. The platform allows the fundraiser to nominate up to three treasurers who must approve withdrawals.

Currently subscribers of mobile networks Safaricom and Airtel can organise and donate to a fundraiser on M-Changa. The start-up has also partnered with Equity Bank making it possible for the banks’ customers to participate in fundraisers via mobile wallet and over the counter.

Donors outside of Kenya can also contribute via PayPal and credit card. The collected funds are held in a trust and can be withdrawn by the fundraiser whenever they wish. M-Changa charges a service fee of 4.25% of the total amount collected.

Growing beyond Kenya

Mullei believes there is opportunity to build a sustainable business beyond Kenyan borders. Even in today’s modern society, most people are not integrated in a national social security system.

“Across Africa insurance penetration is just about 3.6%, that means when someone has an emergency, they are not pulling out their insurance card but are going to their families for help,” he says.

From next month M-Changa will be piloted in Tanzania, enabling subscribers of telco company Tigo to fundraise via the platform.

“Tanzania is interesting to us because it is more representative of the African market. The Kenyan market has one dominant player which operates the de facto mobile money infrastructure in the country,” says Mullei. “But in Tanzania there are four players and everyone is trying to get ahead of the competition unlike in Kenya where Safaricom really moves at its own pace.

“We want to see how M-Changa would work in a much more competitive market which is really how the rest of Africa is. Tanzania would give us preliminary proof of concept as we prepare for expansion to other markets.”

But for M-Changa to be truly successful, it needs to be accessible to people through as many payment options as possible. In coming months, Mullei says M-Changa will forge partnerships with more mobile operators and banks.

“There has to be no friction on the participation part. One shouldn’t have an excuse not to fundraise,” he explains.

“We talk about the success of mobile money a lot, but in terms of actual value, banks are still moving more money. Besides, all banks in Kenya have a mobile platform. So they will help us reach more people,” he concludes. “The future is really banks.”–howwemadeinafrica