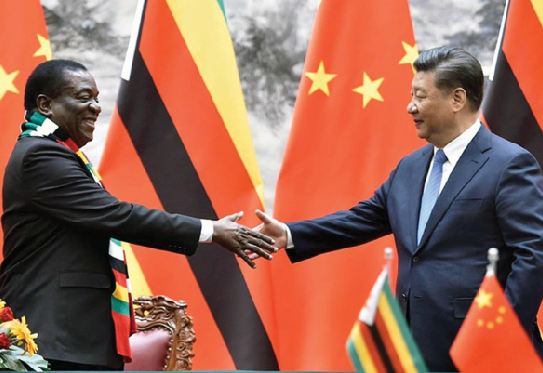

How good has China been to Zim, Africa?

In Zimbabwe for instance, airport infrastructure upgrades, energy projects as well as information and

communication technology (ICT)initiatives rank among the top funded projects by the Chinese.

Billions of US dollar investments from China have flown into needy or critical areas of

many African countries, Zimbabwe included, after the traditional global funders

tightened their purse strings, experts have said.

In the past decade, Chinese lending to African countries has significantly increased, when the region is struggling to access loans from other funders as the debt burden continues to haunt the region.

Zimbabwe for instance, has been isolated from international funders since the turn of the millennium, in addition to battling an onerous debt inherited from the Rhodesian government at independence.

Experts have indicated that Chinese investments have come in handy addressing some of the region’s major challenges, for instance yawning infrastructure gaps.

According to a Chinese loans to Africa database, over US$150 billion has been committed to the region for 1 141 projects.

Of these loans, the transport and energy sectors account for the largest chunks of US$46,6 billion and US$38,08 billion, respectively.

In Zimbabwe for instance, airport infrastructure upgrades, energy projects as well as information and communication technology (ICT) initiatives rank among the top funded projects by the Chinese.

Figures show that China has channelled US$3 billion to Zimbabwe for 29 projects. Of these, the energy sector accounted for US$1,4 billion followed by ICTs at US$442 million, and then transport and defence at US$256 million and US$257 million, respectively. Agriculture, water and health accounted for US$226 million, US$124 million and US$92

million, in that order. Stand out projects financed by China in Zimbabwe include the US$333 million expansion

of Kariba South 7 and 8 project, US$1,1 billion Hwange Power Station 7 and 8 project, which is currently underway, the ongoing US$150 million expansion of Robert Gabriel Mugabe International Airport and a similar investment on Victoria Falls International Airport.

China also financed the construction of the Zimbabwe National Defence College at a cost of US$100 million and also provided funding for the 650-seater Parliament House in Harare, which is currently under construction and nearing completion.

Speaking at the ongoing three day annual multi-stakeholder debt conference African Forum and Network on Debt and Development (AFRODAD) in conjunction with Zimbabwe Coalition on Debt and Development (ZIMCODD) in Harare, Beijing based consultancy firm- Development ReImagined’s Patrick Anam said:

“For African countries to develop, they need infrastructure. “One way of doing this is through loans. The loans from China therefore need to be looked at from the perspective of what Africa needs to do. Is it building roads, schools,

hospitals, energy infrastructure?” Mr Anam attended the conference virtually.

John Hopkins University director of China Research Initiative, Professor Deborah Brautigam also highlighted the Chinese loans were mainly investments into infrastructure as opposed to consumption which should spearhead development.

“Airport upgrades will allow tourists to come.

“There is also an aspect of job creation although we can debate on the quality of jobs,” she said in a virtual presence.

Over the past decades, incidences of weather induced disasters have further exposed African countries to poverty and increased appetite to borrow resulting in the region trapping itself in huge debts.

For Zimbabwe, high debt service obligations, fiscal deficits, stunted growth and constrained new external financing in the 1990s culminated in a net outflow of resources resulting in the country first defaulting by year 2000, while the ZIDERA also isolated the country from the international financial system.

As of December 2020, the country’s public and publicly guaranteed debt to gross domestic product (GDP) ratio was at 72,6 percent, although the National Development Strategy (NDS1) aims to keep the ratio at below 70 percent.

Also commenting on the issue, legislator Mr Edmond Mkaratigwa highlighted the need for African countries to come up with their own strategies that complement the Chinese foreign policy and investments for the region to derive maximum benefits.

“These investments speak to our areas of needs and it should be a win-win situation, we should derive benefits from them,” he said. He added the need for due diligence on the part of Zimbabwe and other African countries

as recipients of loans.-eBusiness Weekly